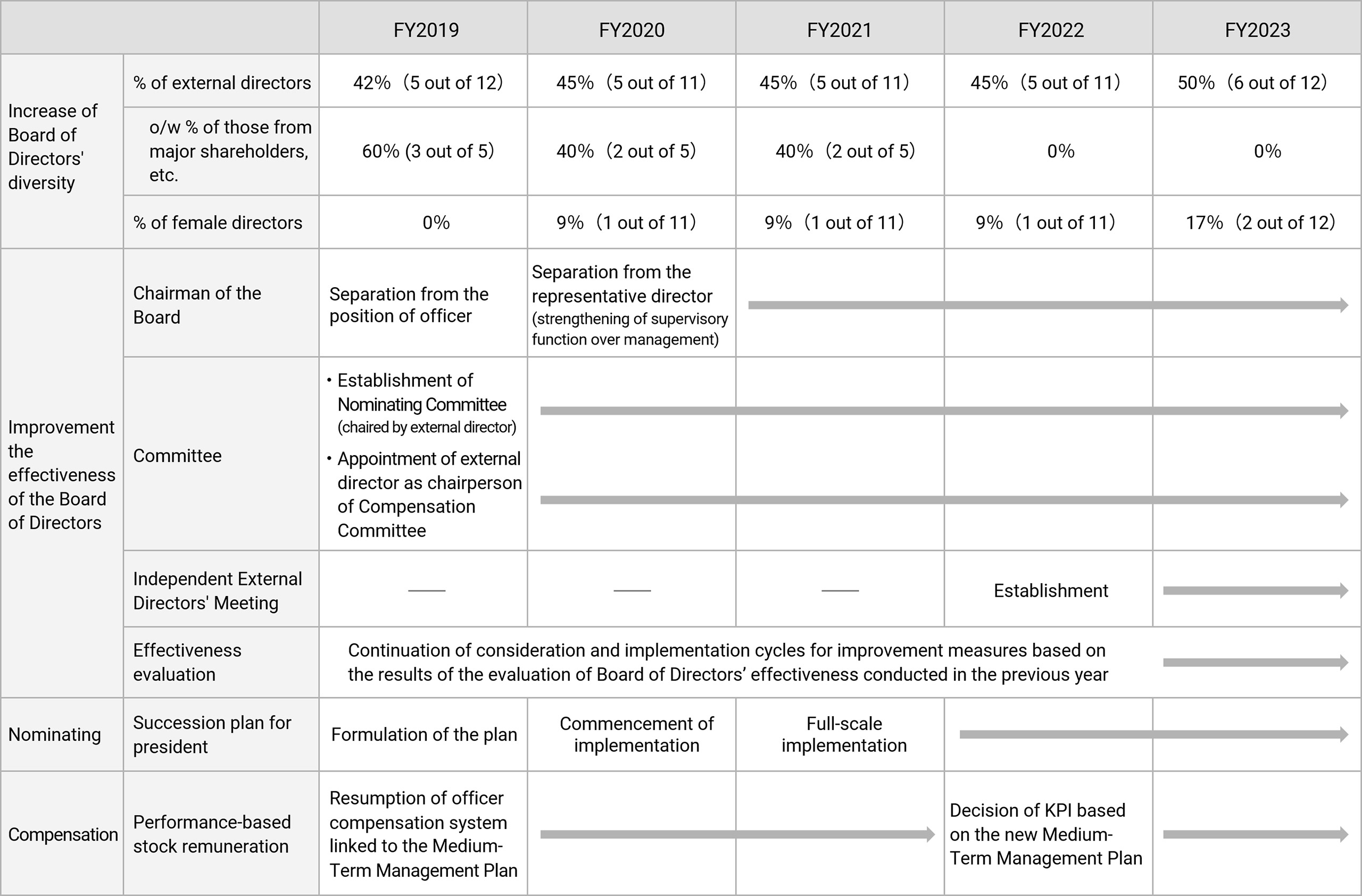

Corporate Governance Enhancement Initiatives

Secure Independence of External Directors: More diverse board composition

Changes in board composition

Swipe horizontally to view full table.

| As of the end of | |||||

|---|---|---|---|---|---|

| June 2019 | June 2020 | June 2021 | June 2022 | June 2023 | |

| Total number of directors (incl. Audit and Supervisory Committee members) |

12 | 11 | 11 | 11 | 12 |

| o/w external directors | 5 | 5 | 5 | 5 | *6 |

o/w those from major shareholders, etc. |

3 | 2 | 2 | 0 | 0 |

| o/w female directors | 0 | 1 | 1 | 1 | 2 |

(*) External Directors as of the end of June 2023

- Mr. Shigeru Murayama, Senior Strategic Advisor, Kawasaki Heavy Industries, Ltd.

- Mr. Makoto Sumita, former Chairman & Director, TDK Corporation

- Mr. Tsuneyoshi Tateoka, former Vice Minister of Economy, Trade and Industry

- Mr. Shiro Hiruta, former Counsellor, Asahi Kasei Corporation

- Ms. Asako Yamagami, Partner, ITN law office

- Ms. Michiko Chiba, Commissioner of Certified Public Accountants and Auditing Oversight Board

Nominating Committee members

- 4 external directors and 1 internal director (chaired by an external director)

Officer compensation system aimed at enhancing corporate value

New system of officer compensation linked to business performance in effect since FY2022

Compensation system and performance-based structure

Swipe horizontally to view full table.

| Fixed compensation | Performance-based compensation | ||||

|---|---|---|---|---|---|

| Fixed monthly compensation | Short-term business performance | Medium-term business performance | Long-term business performance | ||

| Bonus | Performance-based stock remuneration | Restricted stock remuneration | |||

| Ratio of compensation | 1 | 0.6-0.7 | 0.1-0.225 | 0.3-0.45 | |

| Linked KPI | — |

|

|

(Assignment restrictions until retirement) | |

| Degree of linkage with performance | — | 0-200% | 0-150% | Linked to stock price | |

| Payment method | Cash | Stock | |||

| Malus and clawback (*2) | Applies | ||||

- (*1) ROE refers only to the last fiscal year of the Medium-Term Management Plan.

- (*2) Malus: A clause that allows for the reduction or cancellation of vested incentive compensation before its payment if fraud or misconduct by the officer is identified.

Clawback: A clause to have paid compensation returned in situations similar to the above.

Compensation Committee members

- 2 external directors and 2 internal director (chaired by an external director)

Establishment of the Independent External Directors' Meeting

The Company has established an Independent External Directors' Meeting whose members are all external directors in November 2022. The meeting serves as an opportunity for the members to freely exchange opinions and have discussions from an independent and objective standpoint about issues and matters to be deliberated by the Board of Directors. Based on the results of this meeting, the Independent External Directors' Meeting makes proposals to the Board of Directors and helps stimulate discussions at Board of Directors' meetings.

History of Enhancing Corporate Governance