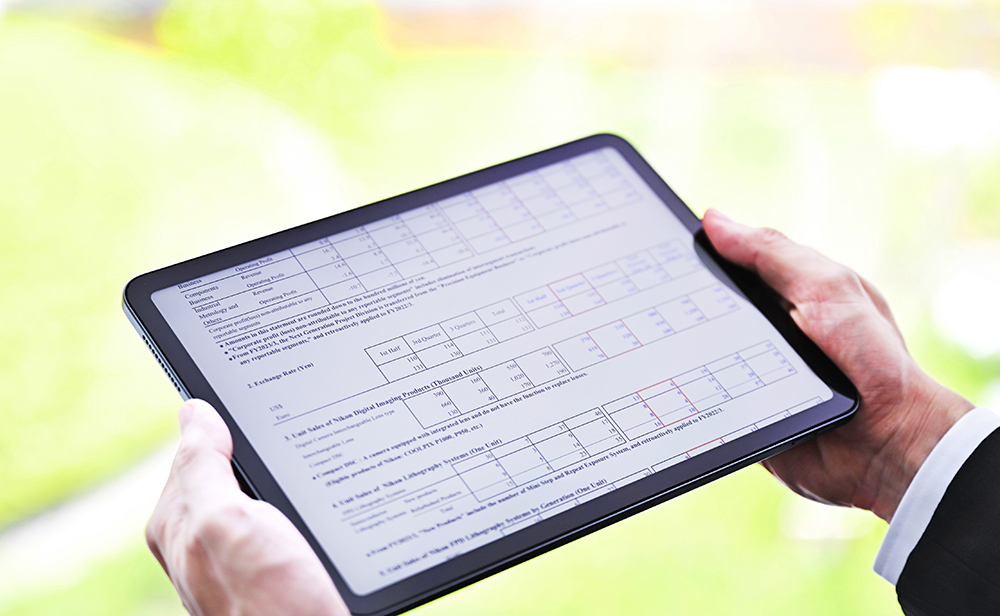

Financial Highlights

Operating Results and Financial Position (annual)

During the fiscal year ended March 31, 2025, revenue decreased 1,960 million yen (0.3%) year on year to 715,285 million yen, operating profit decreased 37,354 million yen (93.9%) year on year to 2,422 million yen, profit before tax decreased 38,136 million yen (89.4%) year on year to 4,533 million yen, and profit attributable to owners of parent decreased 26,447 million yen (81.2%) year on year to 6,123 million yen.

Imaging Products Business

The Group recorded a year-on-year increase in revenue due to an increase in the number of interchangeable lenses and mirrorless cameras sold, mainly Z50II APS-C size mirrorless camera, Z6III fullframe mirrorless camera, and other new products, as well as the positive effects of the yen depreciation. The Group, however, recorded a year-on-year decrease in profit due to the operating loss of RED, which was affected by the sluggish cinema industry, and the recognition of one-time costs such as impairment losses on non-current assets at Mark Roberts Motion Control Limited.

As a result, this business segment recorded revenue of 295,363 million yen (up 5.6% year on year) and operating profit of 41,306 million yen (down 11.3% year on year).

Precision Equipment Business

The FPD lithography systems field recorded year-on-year increases in both revenue

and profit due to higher unit sales of the systems for both mid-to-small size panels and large-size panels.

In contrast, the semiconductor lithography system field recorded year-on-year decreases in both revenue and profit due to lower unit sales of new systems as well as the recording one-time costs such as impairment losses on non-current assets and writedown of inventories.

As a result, this business segment recorded revenue of 201,963 million yen (down 7.9% year on year) and operating profit of 1,544 million yen (down 89.8% year on year).

Healthcare Business

The Group recorded year-on-year increases in both revenue and profit as a whole backed by

robust sales and the positive effects of the yen depreciation in the eye care solutions and contract cell development and manufacturing fields, despite being adversely affected by sluggish market conditions in the life science solutions field.

As a result, this business segment recorded revenue of 116,452 million yen (up 7.9% year on year) and operating profit of 6,735 million yen (up 25.0% year on year).

Components Business

The Industrial Solutions Business recorded year-on-year decreases in both revenue and profit as sales of optical parts and encoders declined, despite steady growth in sales of large-size X-ray and CT inspections systems.

Likewise, the Customized Products Business, which also belongs to this business segment, recorded year-on-year decreases in both revenue and profit as sales of EUV-related components were adversely affected by a slowdown in the EUV-related markets.

As a result, this business segment recorded revenue of 74,136 million yen (down 13.7% year on year) and operating profit of 7,185 million yen (down 52.5% year on year).

Digital Manufacturing Business

The Group recorded a year-on-year increase in revenue because sales of largesize equipment remained strong, while sales of mid-to-small size equipment decreased. The Group, however, recorded a year-on-year decrease in profit due to higher production costs resulting from lower production volume of mid-to-small size equipment, the organization of the U.S. footprint, and increased upfront investments in R&D and other areas.

As a result, this business segment recorded revenue of 23,356 million yen (up 11.2% year on year) and operating loss of 15,225 million yen (operating loss of 14,093 million yen in the previous fiscal year).