CVC Activities

Overview of CVC (Corporate Venture Capital) Activities

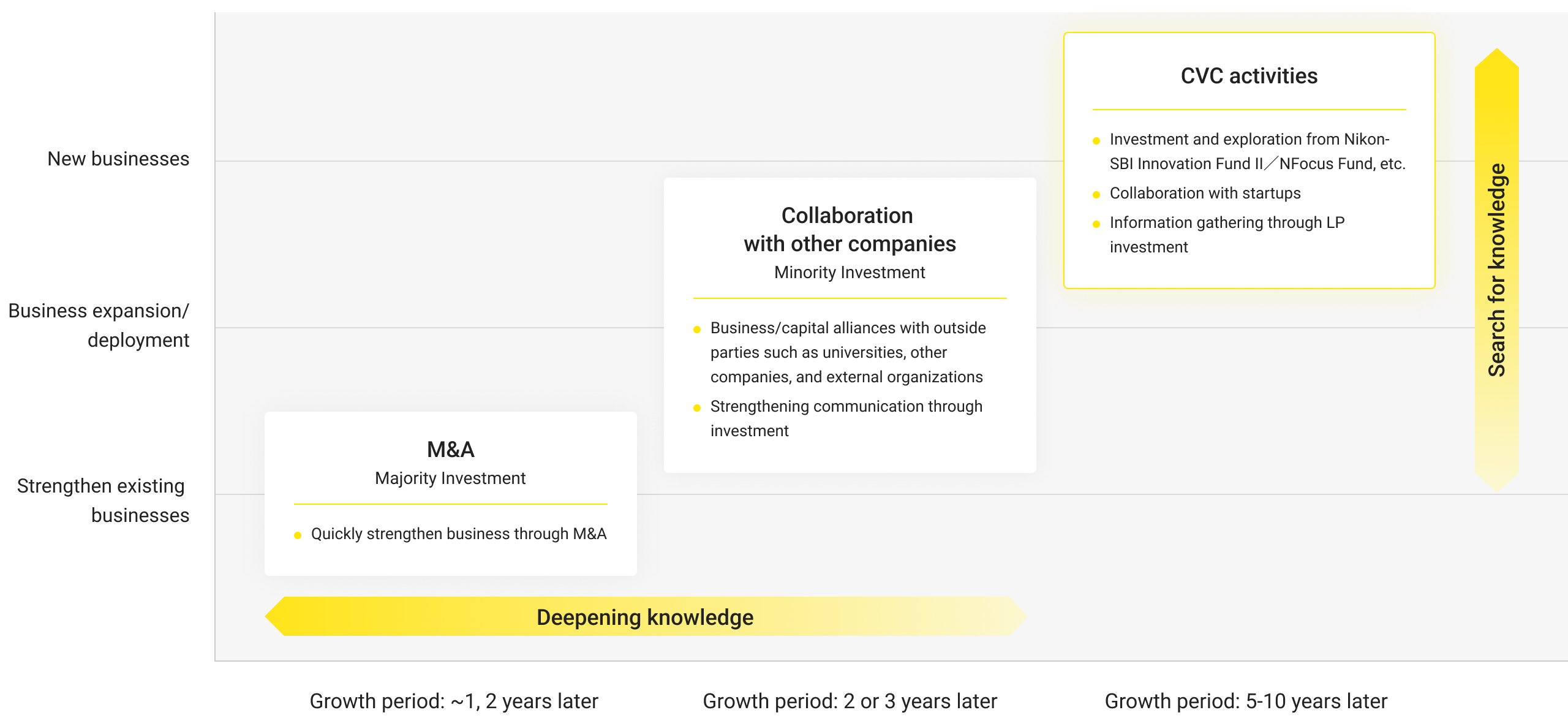

A private equity investment fund to invest in startups was jointly established with SBI Investment Co., Ltd. in July 2016, and a second fund was established in November 2023. Additionally, on August 6th, 2024, we established NFocus Fund in collaboration with Geodesic Capital (California, USA).

In order to expand our target areas not only to Nikon’s existing businesses but also to new fields, we are searching for startups that have the potential to create a future story together with Nikon from a broad perspective, mainly in Japan and North America, but also in Europe and Asia, and are promoting activities to create new businesses through investments and collaboration with startups.

Click to enlarge

Investment Areas

In the area of investment, in addition to the areas in which we provide value toward 2030 as determined in our Medium-Term Management Plan, from a longer-term perspective, we are conducting a variety of activities such as information gathering, investment, and collaboration, focusing on the five areas of Space, Carbon Neutral, Energy, Robotics, and Bio/Healthcare.

Click to enlarge

Latest Activities

Joint Establishment of a Second Corporate Venture Capital Fund with SBI Investment

Through collaboration with SBI Investment Co., Ltd., a wholly owned subsidiary of SBI Holdings Co., Ltd., Nikon has established “Nikon-SBI Innovation Fund II,” a corporate venture capital fund that will invest in cutting-edge technologies and services such as aerospace, energy, and carbon neutral as new fields that look beyond Nikon’s Medium-Term Management Plan. The fund size is 5 billion JPY, and the operation period is scheduled to be 7 years (until 2030).

Nikon is actively seeking collaboration with startups and developing human resources through employee secondments. In addition to incorporating cutting-edge technologies and business models possessed by startups, we aim to promote the creation and development of new businesses and realize business synergies.

Investment Status (from July 2016 to September 2024)

- Investment in domestic and overseas startups (new investment: 21 companies, additional investment: 8 companies, under consideration: several companies)

- Invested in 500 Startups Japan, which explores and accelerates a wide range of overseas deals, and Coral Capital, which also explores deep tech

- The corresponding business department will take the lead in considering additional investment and business development for the next round while considering business synergies with the investee

Portfolio

Click to enlarge

Co-founded NFocus Fund with Geodesic Capital

Nikon Corporation jointly established NFocus Fund, a private equity investment fund, On August 6th, 2024 in collaboration with Geodesic Capital (California, USA). Nikon is investing as an anchor limited partner in establishing this fund.

Nikon’s Medium-Term Management Plan (FY2022-FY2025) states that its Vision 2030 is to become “a key technology solutions company in a global society where humans and machines co-create seamlessly.” With an eye on achieving our vision and further growth, we will invest in early to mid-stage startup companies through NFocus Fund, leading to Nikon’s technological innovations in multiple strategic areas.