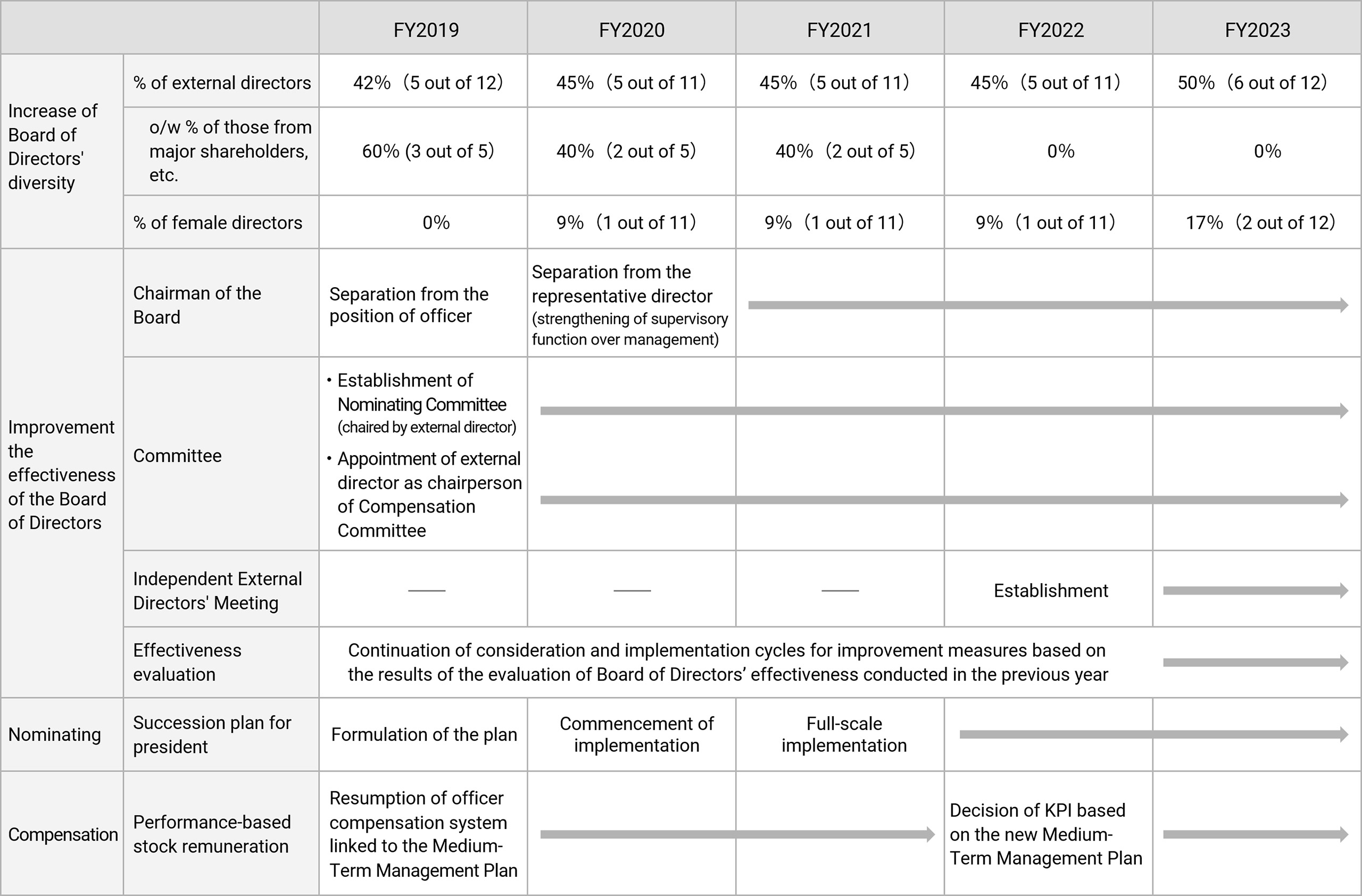

Initiatives to Enhance Corporate Governance

Expanding Board Diversity

The composition of the Board of Directors is designed to ensure that the Board as a whole can demonstrate its effectiveness, taking into account the need to secure diversity and an appropriate number of members.

Changes in board composition

External Directors as of July 1, 2024

- Shiro Hiruta, Chairman of the Board (former Counsellor of Asahi Kasei Corporation)

- Makoto Sumita (former Chairman & Director of TDK Corporation)

- Tsuneyoshi Tatsuoka (former Vice Minister of Economy, Trade and Industry)

- Shigeru Murayama, Chairperson of Audit and Supervisory Committee (former Senior Strategic Advisor of Kawasaki Heavy Industries, Ltd.)

- Asako Yamagami, Audit and Supervisory Committee Member (Partner of ITN law office)

- Michiko Chiba, Audit and Supervisory Committee Member (Commissioner of Certified Public Accountants and Auditing Oversight Board)

Enhancement of Board Effectiveness

The Board of Directors is improving its effectiveness through a variety of initiatives.

Chairperson of the Board

FY2020: A non-executive director assumed as chairperson. (To strengthen operational supervision)

Nominating Committee

As a voluntary advisory body to the Board of Directors, the Nominating Committee primarily formulates criteria for the election and removal of the chief executive officer, president, and directors, nominates candidates, considers the composition of the Board of Directors, and oversees evaluation and assignment of officers, etc.

FY2019: Established the Nominating Committee

FY2020: Started operation of the succession plan for the President

FY2023: President was selected for the first time since the establishment of the Nominating Committee

Committee composition: 3 external directors and 2 internal directors (chaired by an external director)

Compensation Committee

As a voluntary advisory body to the Board of Directors, the Compensation Committee deliberates and makes proposals for policy regarding executive compensation as well as various related systems.

FY2003: Established the Compensation Committee

FY2019: An external director assumed as chairperson.

FY2024: Majority of members of the committee changed to external directors

Committee composition: 3 external directors and 2 internal directors (chaired by an external director)

Independent External Directors' Meeting

External directors freely exchange opinions on the issues and matters to be discussed by the Board of Directors based on an independent and objective standpoint, thereby vitalizing the discussions at the Board of Directors.

FY2022: Established the Independent External Directors' Meeting

Evaluation of the Board of Directors' effectiveness

The Company asks a third-party organization to analyze and evaluate the effectiveness of its Board of Directors in order to further improve its functions. Based on the results of the previous year's evaluations, the Company continues the cycle of studying and implementing improvement measures.

Compensation system and performance-based structure

FY2022: Started applying a new performance-based executive compensation system. (See the table below for an overview of the system.)

Swipe horizontally to view full table.

| Fixed compensation | Performance-based compensation | ||||

|---|---|---|---|---|---|

| Fixed monthly compensation | Short-term business performance | Medium-term business performance | Long-term business performance | ||

| Bonus | Performance-based stock remuneration | Restricted stock remuneration | |||

| Ratio of compensation | 1 | 0.6-0.7 | 0.1-0.225 | 0.3-0.45 | |

| Linked KPI | — |

|

|

(Assignment restrictions until retirement) | |

| Degree of linkage with performance | — | 0-200% | 0-150% | Linked to stock price | |

| Payment method | Cash | Stock | |||

| Clawback*2 | Applies | ||||

- *1 ROE refers only to the last fiscal year of the Medium-Term Management Plan.

- *2 Clawback: A clause to have paid compensation returned if fraud or misconduct by the officer is identified.

History of Enhancing Corporate Governance

- * The change of president was in April 2024