Message from the COO & CFO

August 2024

As COO and CFO

In April 2024 I was appointed President, COO and CFO. With Toshikazu Umatate taking on the responsibility for overall strategy in his role as Chairman, CEO, I am charged with executing operations and financial management for the entire company.

In the fiscal year 2020, the impact of COVID-19 resulted in Nikon recording revenue of 451.2 billion yen, an operating loss of 56.2 billion yen, and a loss attributable to owners of parent of 34.4 billion yen, the largest loss in our history going back more than 100 years. However, revenue has since recovered to more than 700.0 billion yen.

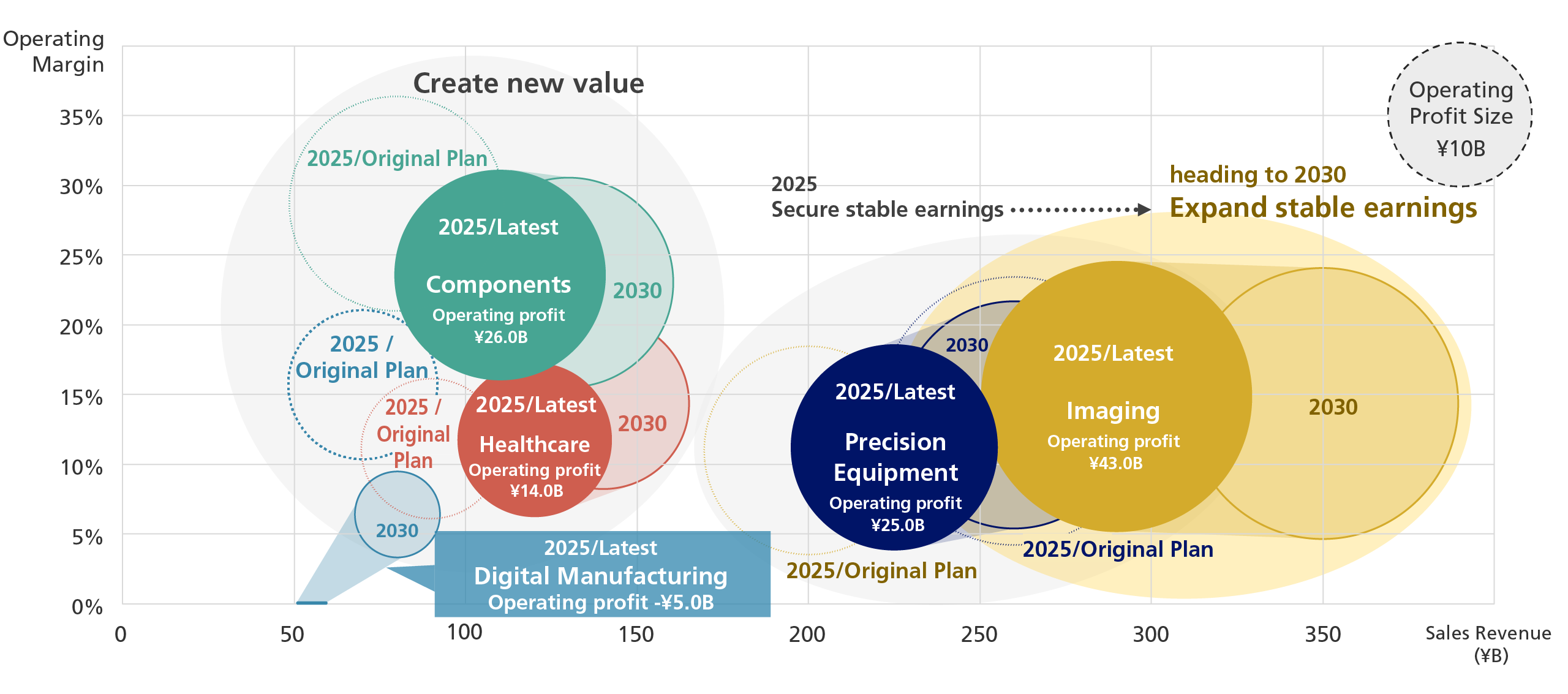

The strategy and various measures aimed at achieving the 2030 vision, described in the Medium-Term Management Plan (FY2022 - 2025), of becoming “a key technology solutions company in a global society where humans and machines co-create seamlessly,” are proceeding more or less satisfactorily.

Nevertheless, I believe that achieving further sustainable growth for Nikon requires the management base to be strengthened even further. In other words, as well as moving steadily forward with human capital management focused on acquiring, developing, and leveraging human resources and the sustainability strategy under the slogan of making contributions to society through creativity (business), we will invest in IT/DX, which is an area where in the past our commitments have not necessarily been sufficient, in addition to investing in manufacturing through organizing a production footprint that supports all our businesses, and other initiatives. We will also strengthen group governance, which includes overseas subsidiaries and companies in which Nikon has invested and put in place a global compliance structure.

This strengthening of the management base will incur expenditures. Specifically, we believe that investments in IT/DX up to 2030 will require approximately 30.0 billion yen, and the organization of our production footprint will require about ¥100.0 billion yen.

While systematically implementing these investments and expenditures, we need to be sure to secure earnings every fiscal year. My mission, as both COO (operations) and CFO (financial management), is to rationally consider the balance between these two aspects, and then execute them in practical terms.

I aim to achieve sustainable increases in corporate value by carrying out operations and financial management in accordance with the Medium-Term Management Plan.

Looking back at FY2023

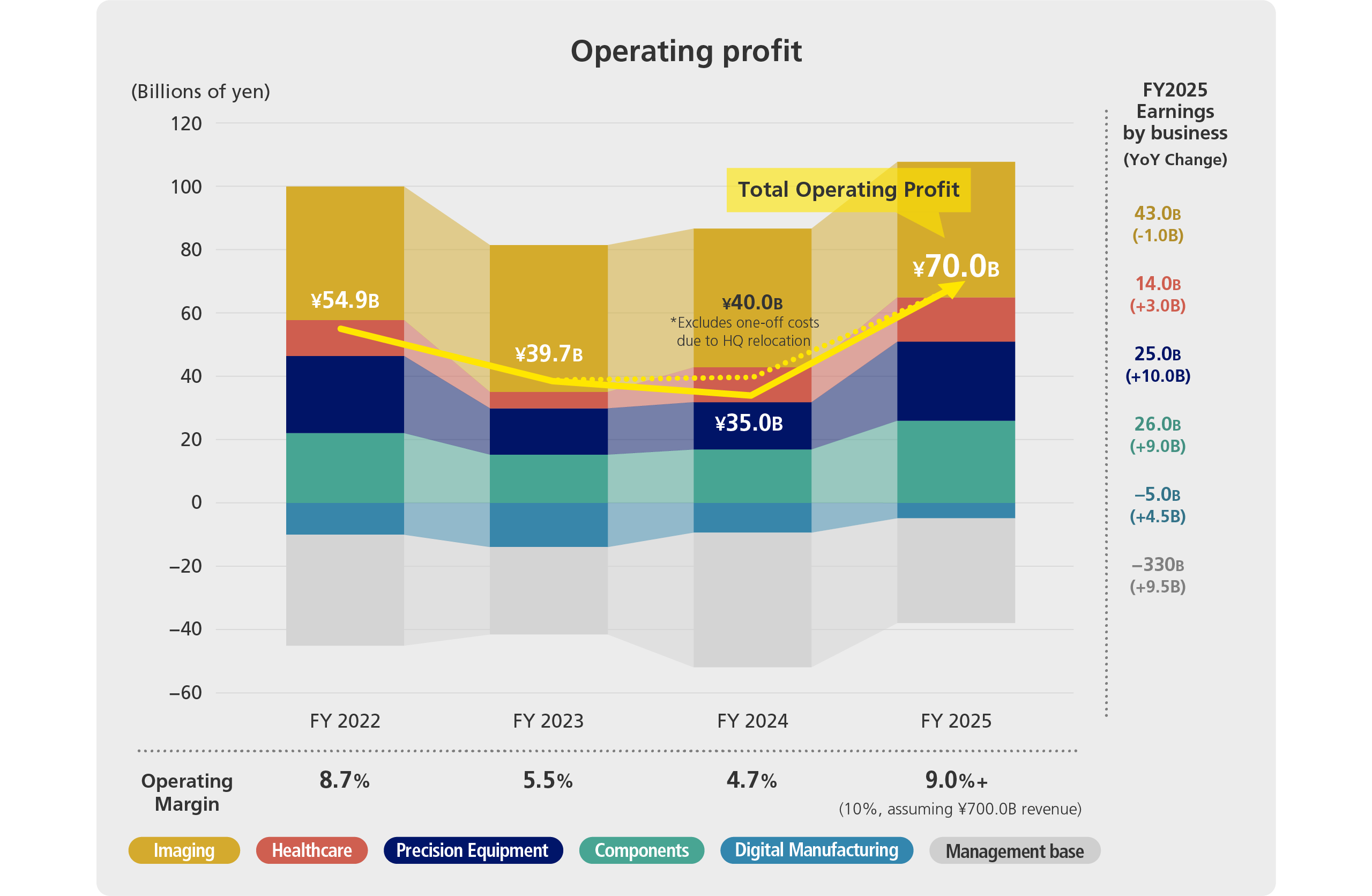

In FY2023, which was the second year of the Medium-Term Management Plan, revenue increased 89.1 billion yen year on year to 717.2 billion yen, operating profit decreased 15.2 billion yen year on year to 39.7 billion yen, profit attributable to owners of parent decreased 12.4 billion yen year on year to 32.5 billion yen, and ROE was 5.0%.

Although the Imaging Product Business continued to perform well and increased operating profit, operating profits declined in the Precision Equipment Business where sales volume of FPD lithography systems and service revenue reduced and in the Components Business. These factors, in addition to one-time costs incurred in the Healthcare Business and the Digital Manufacturing Business, resulted in a decrease in operating profit overall.

In terms of strategy, in the Imaging Products Business we announced the acquisition of US-based digital cinema camera manufacturer RED.com, LLC (hereinafter “RED”), which has a unique customer base and technologies, thus taking a major step towards opening up the professional cinema camera market. Moreover, in the Digital Manufacturing Business, which has been designated a strategic business, we pursued business expansion by establishing Nikon Advanced Manufacturing Inc. in the US to control the additive manufacturing business globally, which includes the acquired German metal 3D printer manufacturer Nikon SLM Solutions AG (hereinafter “SLM”).

Outlook for FY2024, and for FY2025, the final year of the Medium-Term Management Plan

(Details announced in May 2024)

For FY2024, we forecast higher revenue and lower operating profit in the form of revenue of 745.0 billion yen, operating profit of 35.0 billion yen, and profit attributable to owners of parent of 30.0 billion yen.

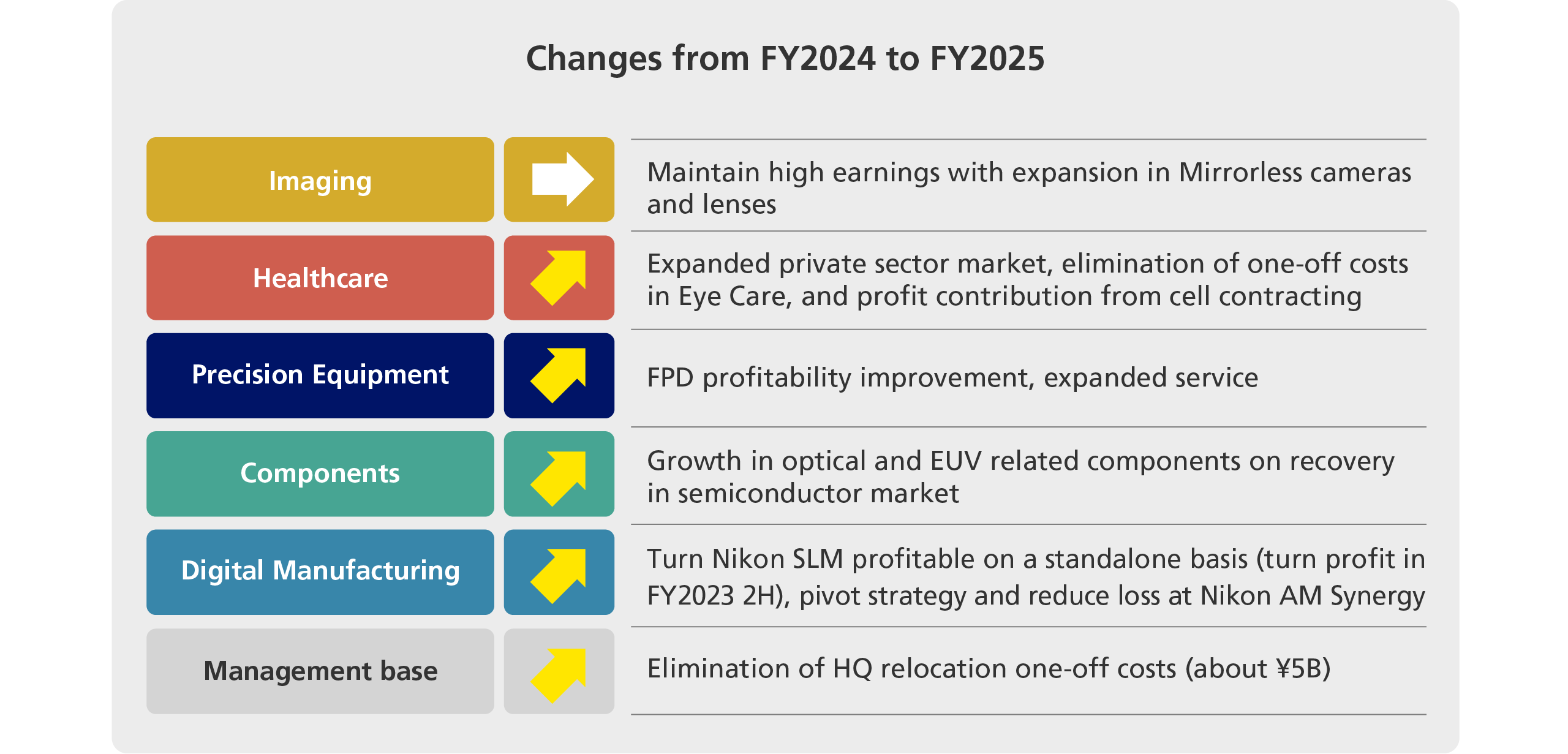

In addition to the expansion of operations in the Healthcare Business and the Digital Manufacturing Business, the increase in revenue is expected to be driven by an increase in unit sales of mirrorless cameras and interchangeable lenses in the Imaging Products Business, as well as the consolidation of RED.

On the other hand, the factors driving lower operating profits are a fall in profit in the Imaging Products Business, primarily due to expenses associated with the acquisition of RED, and an increase in corporate expenses, which are expected to more than offset increases in profits in the Healthcare Business and the Digital Manufacturing Products Business and decreases in one-time costs. However, after excluding one-time headquarters relocation expenses of around 5.0 billion yen, operating profit is forecast to be effectively flat year on year.

In FY2025, the final year of the Medium-Term Management Plan, we forecast that expansion in all businesses and the disappearance of one-time costs such as headquarters relocation expenses will result in both higher revenue and operating profit compared to FY2024.

As we approach FY2030, our objective is to achieve further expansion in all five businesses, including the Digital Manufacturing Business, which is expected to make a profit at the operating level in FY2026.

Capital allocation: investments for strengthening business fundamentals and further enrichment of shareholder returns

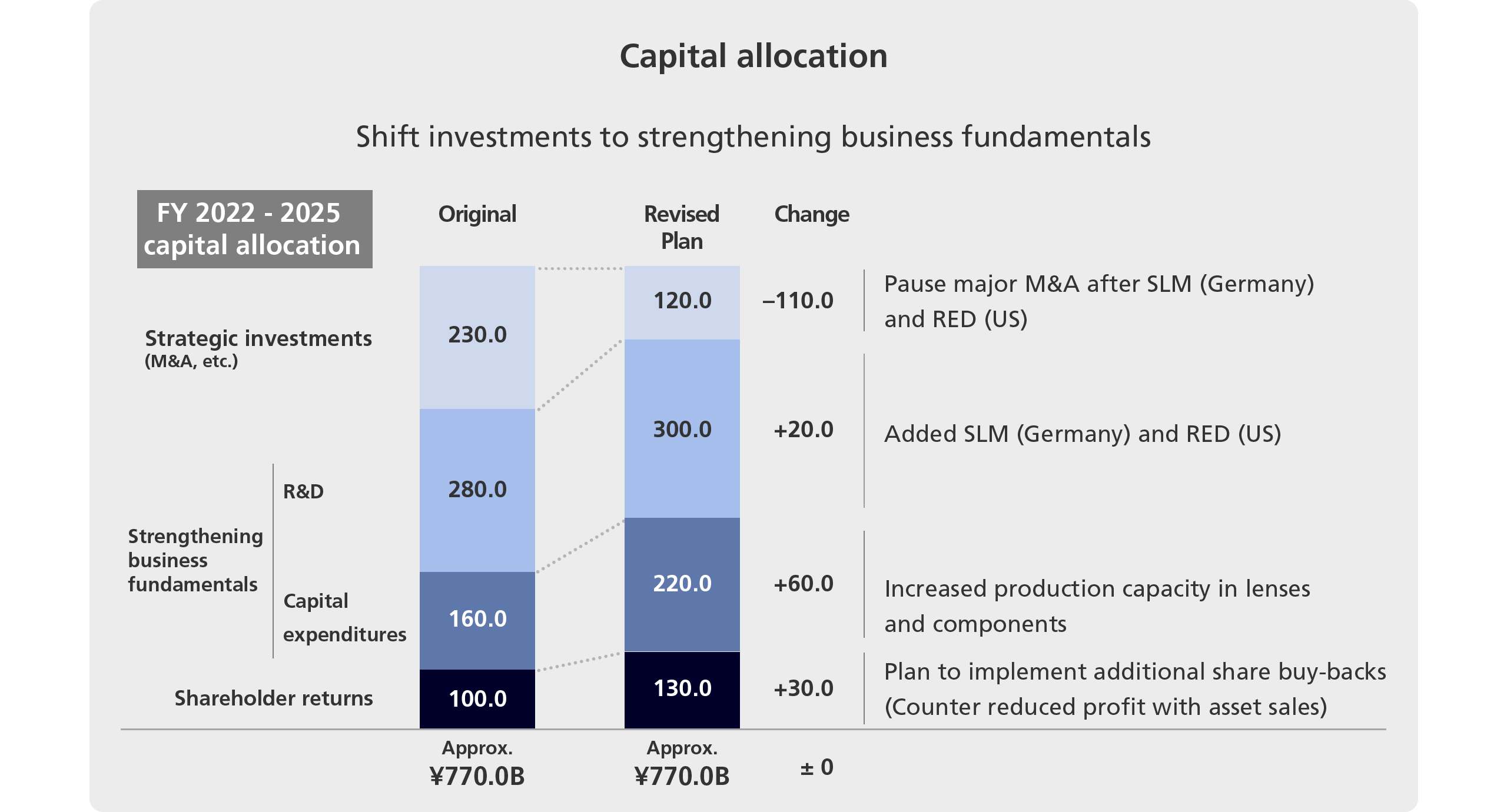

With regard to capital allocation to achieve the growth based on the Medium-Term Management Plan, while maintaining an equity ratio of approximately 55%-60%, we will assign 300.0 billion yen out of the allocable funds of 770.0 billion yen in cumulative funds for distribution over the four years of the Medium-Term Management Plan to R&D, and 220.0 billion yen to capital investments.

Allocation for R&D will be increased including research and development expenses at recent acquisitions SLM and RED. Capital investments will be used to expand production capacity in the Components Business, mainly for semiconductors, in addition to increasing production capacity for various lenses used in from cameras and microscopes to lithography systems.

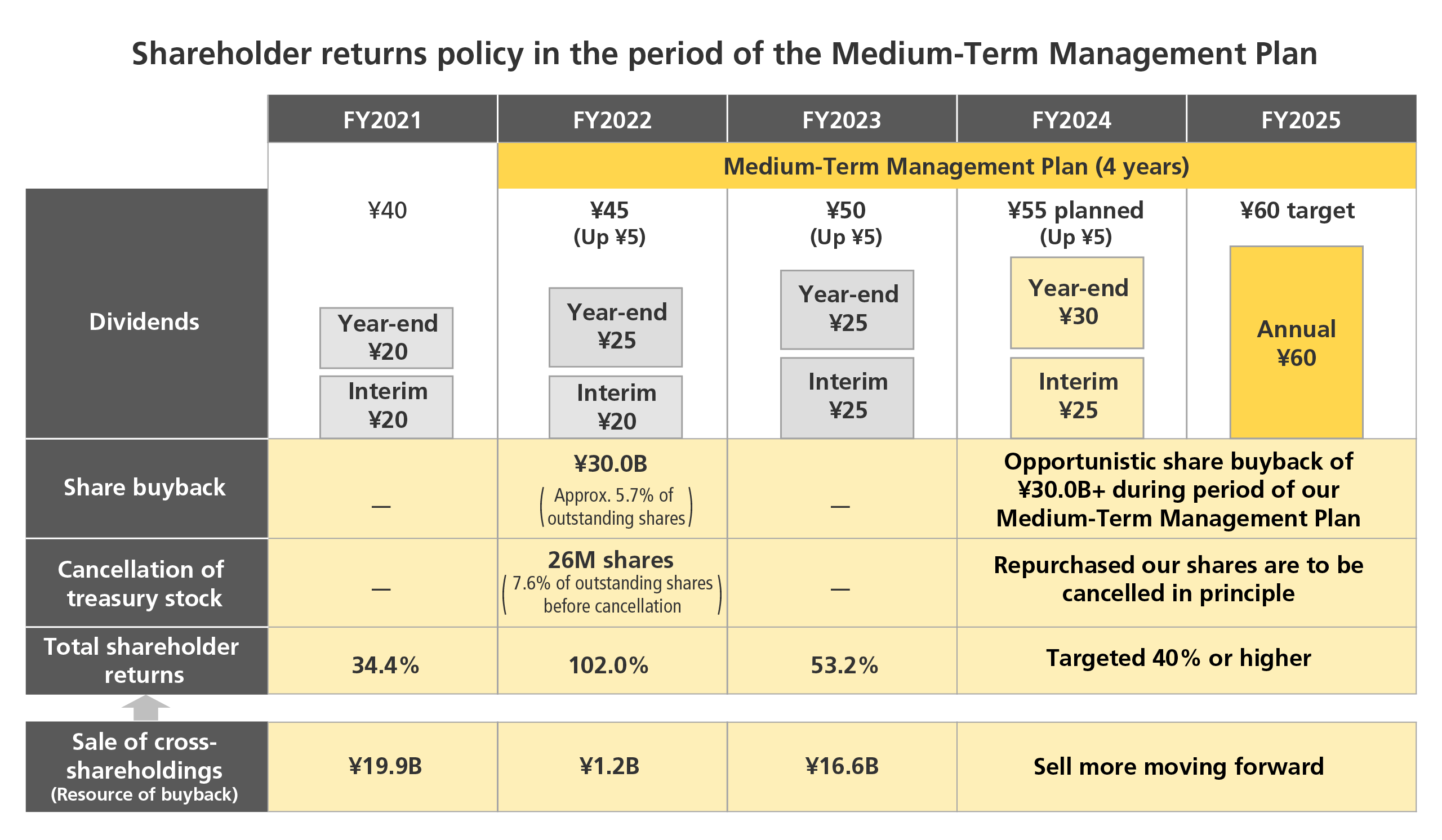

At the same time, we will enrich shareholder returns. We have been raising the dividend per share in stages to hit the target of 60 yen for the final year of the Medium-Term Management Plan, and again in FY2024 we intend to raise it by 5 yen year on year to an annual dividend of 55 yen.

We are moving forward with the sale of cross-shareholdings, and it is our policy to use the cash and deposits generated by the sale, etc. as funds for opportunistic share buybacks of at least 30.0 billion yen during the period of the Medium-Term Management Plan.

By working to establish management practices throughout the Company that are even more focused on balance sheet and cash flow, we seek to achieve improvements in funding efficiency and capital efficiency.

By leveraging to the fullest the advantages of serving as both COO and CFO, I hope to drive sustainable increases in the corporate value of Nikon, and meet the expectations of all stakeholders associated with the Company.

I humbly request your understanding and support going forward.